Description

Institutional Stock Trading Strategy for Thinkorswim: Arrow Buy/Sell Signals

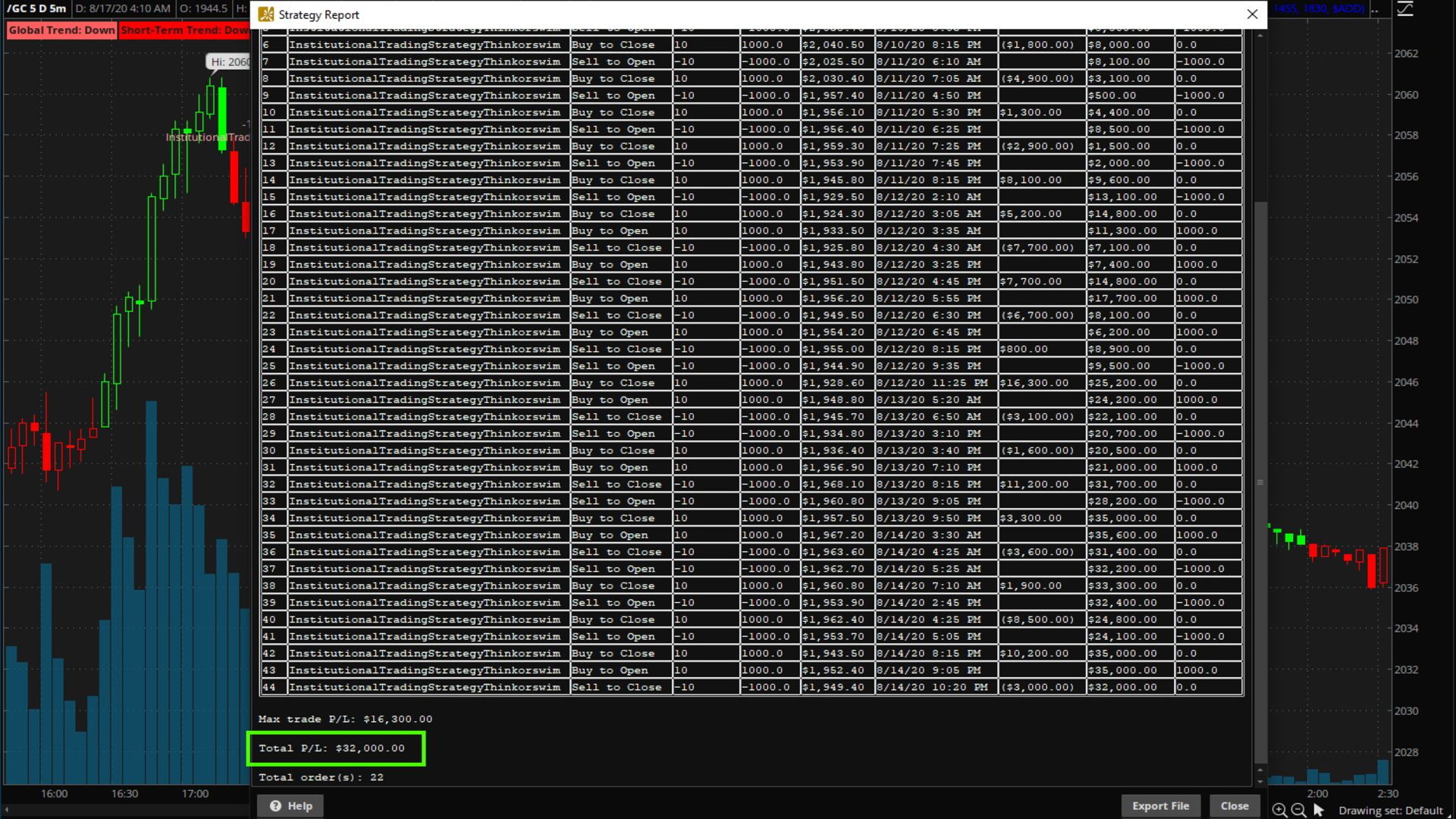

The Institutional Stock Trading Strategy for the Thinkorswim (TOS) platform offers a robust trading system. It helps traders make decisions with accuracy and confidence by predicting future trends, identifying reversal points, and generating clear buy/sell signals. These signals apply to a wide range of assets, including GOLD, S&P 500 e-mini, and Bitcoin futures.

Why Choose the Institutional Stock Trading Strategy?

This strategy works well for both intraday scalping and swing trading, giving you flexibility across different approaches. Its high-precision algorithm allows traders to spot opportunities quickly and react to market changes. Whether you prefer short-term trades or longer-term plays, the arrow signals provide clear, real-time indicators to guide your decisions.

Key Features

- ✅ Accurate Predictions: The strategy forecasts trends and reversal points with high precision, positioning traders to take advantage of market movements.

- ✅ Versatile Usage: It suits both scalping and swing trading, adapting to various trading styles.

- ✅ Buy/Sell Signals for Major Assets: Provides actionable signals for futures like GOLD, S&P 500 e-mini, and Bitcoin futures.

- ✅ Real-Time Trend Detection: Constantly monitors the market, detecting trends in stocks and futures to keep you ahead.

- ✅ Profitable System: Optimized for the Thinkorswim (TOS) platform, the system integrates seamlessly to maximize profitability.

- ✅ Clear Arrow Signals: The built-in signals give easy-to-read visual cues on your charts, simplifying trade decisions.

How It Works

The strategy combines advanced trend analysis, price action, and technical indicators to find high-probability trades. It detects both bullish and bearish trends, allowing traders to capitalize on movements in either direction. Whether you trade GOLD, S&P 500 e-mini, or Bitcoin futures, the strategy ensures well-timed trades with managed risk.

This system is perfect for traders seeking a reliable, profitable, and easy-to-use trading solution with clear buy/sell signals, designed specifically for the Thinkorswim (TOS) platform.