Description

Enhancing Your Strategy with the ATR Indicator for Optimal Stop Loss Levels

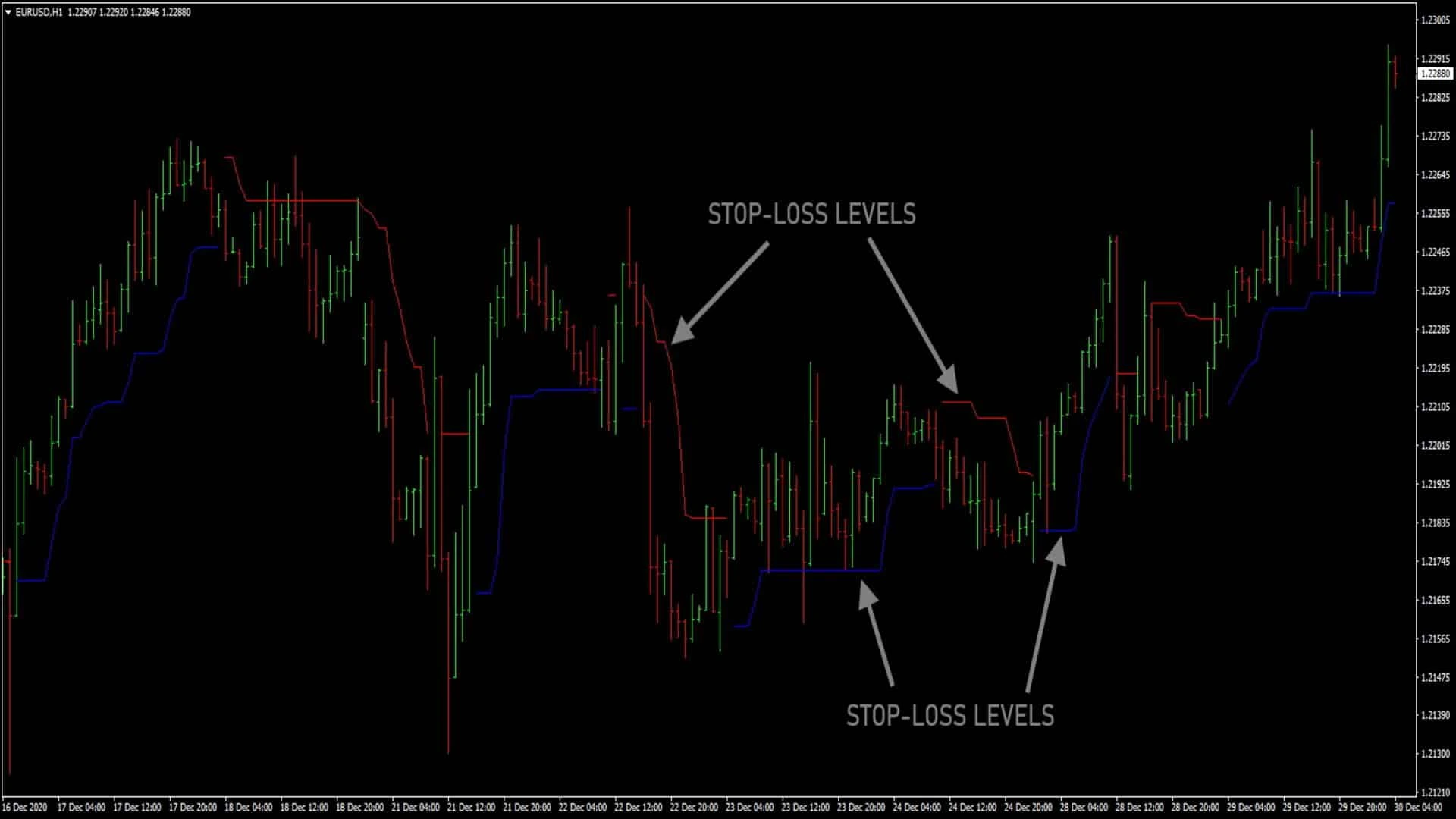

▶️ ATR (Average True Range): ATR measures the average price range over a set period, helping traders understand market volatility. This indicator is especially valuable for setting stop-loss levels and assessing trade potential. It reflects both price highs and lows, making it more comprehensive than simple range measurements. Using ATR, you can better gauge when to enter or exit trades based on how volatile the market is at that time.

▶️ Filtering Noise in Trend Trading: ATR is often paired with other indicators to refine trade signals. It helps traders distinguish between real price movements and market noise, particularly in trend-following strategies. For example, a high ATR might suggest that the price will continue its current trend, while a decreasing ATR can signal a flattening trend. This helps traders avoid unnecessary entries or exits.

▶️ Smart Stop-Loss Placement: By using ATR to set SL levels, you can tailor your approach to current market conditions. High ATR values suggest high volatility, meaning your stop-loss should be wider to accommodate price swings. Conversely, when ATR is low, a tighter stop-loss is more appropriate, protecting against smaller price fluctuations. This dynamic approach helps avoid stops that are too tight or too loose, improving trade success.

▶️ Timing Trade Exits: ATR can also guide when to close positions in trending markets. A high ATR indicates that the trend has momentum, and the position may be held longer. If ATR drops, it suggests reduced volatility and possible trend exhaustion, indicating a good time to consider exiting the trade. This strategy helps capture potential gains while reducing risk exposure.

Example of Setting Stop-Loss Levels with ATR

- Identify the ATR Value: Determine the ATR value at the trade’s start.

- Select a Multiplier: Use a multiplier (e.g., 1, 1.5, or 2) based on your risk preference.

- Calculate SL Distance: Multiply the ATR by the chosen factor. For instance, if ATR is 18 and your multiplier is 1, the stop-loss would be 18 points away.

By incorporating ATR into your strategy, you gain a more adaptive risk management tool. It allows you to make informed decisions in volatile and stable markets, ultimately improving trade outcomes.