Description

Free Forex Indicator Supertrend

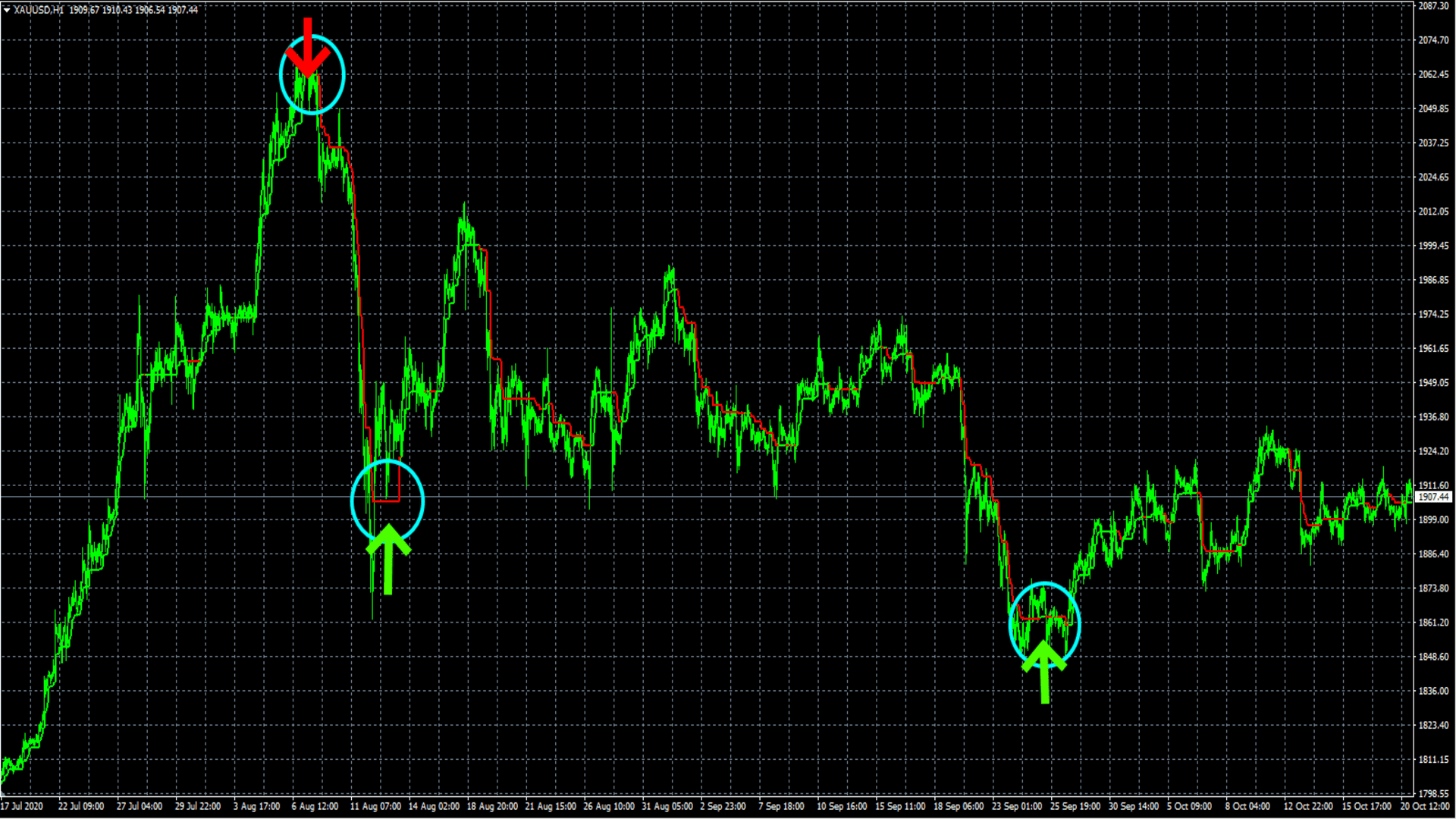

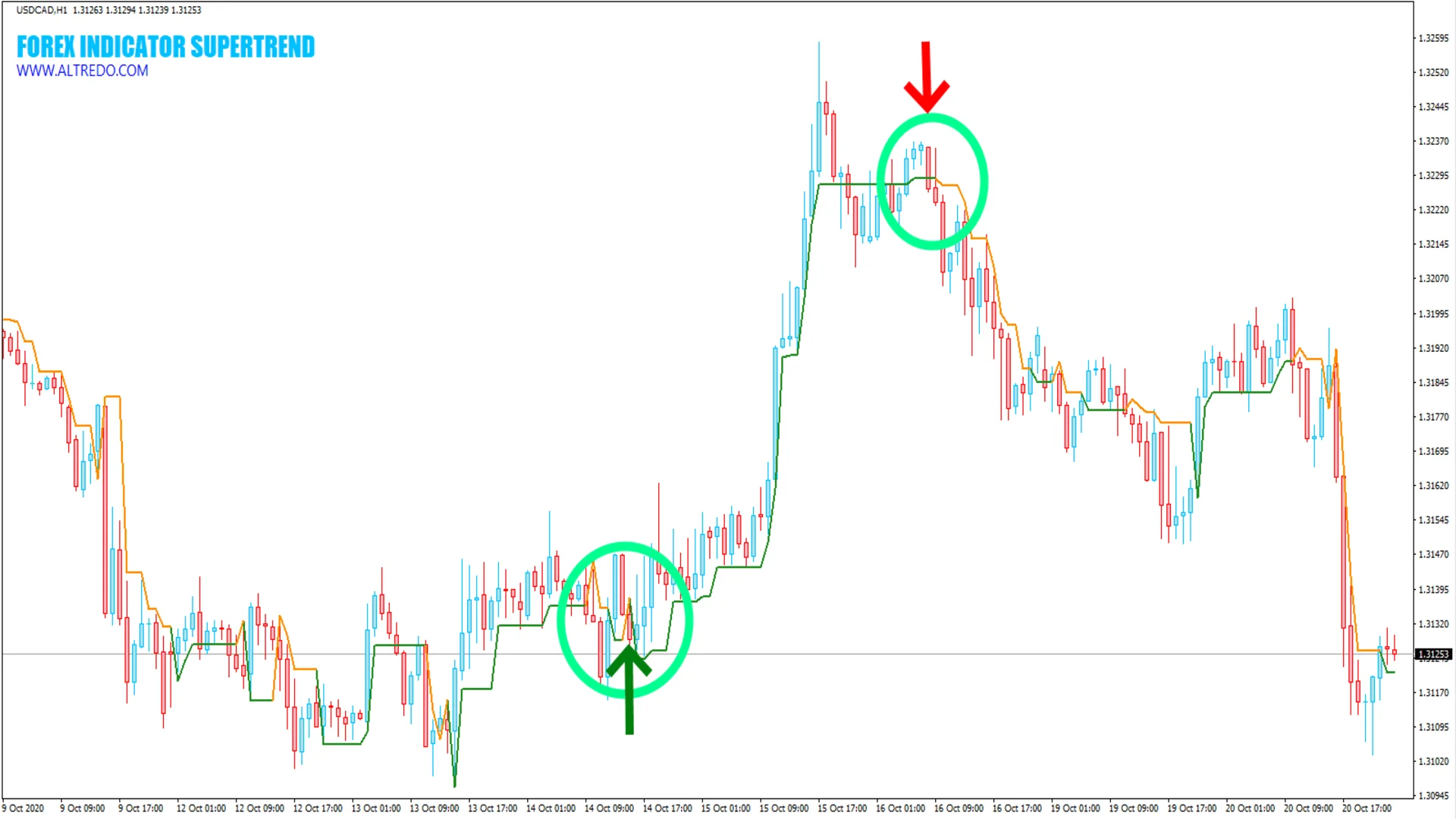

The Forex Indicator Supertrend is a powerful tool for predicting price movement in the forex market. Based on a sophisticated mathematical algorithm, it forecasts trend direction and helps identify trend reversals by generating forex signals. By combining trend analysis with an oscillator, Supertrend enhances accuracy, making it a popular choice among traders.

Using the Forex Indicator Supertrend

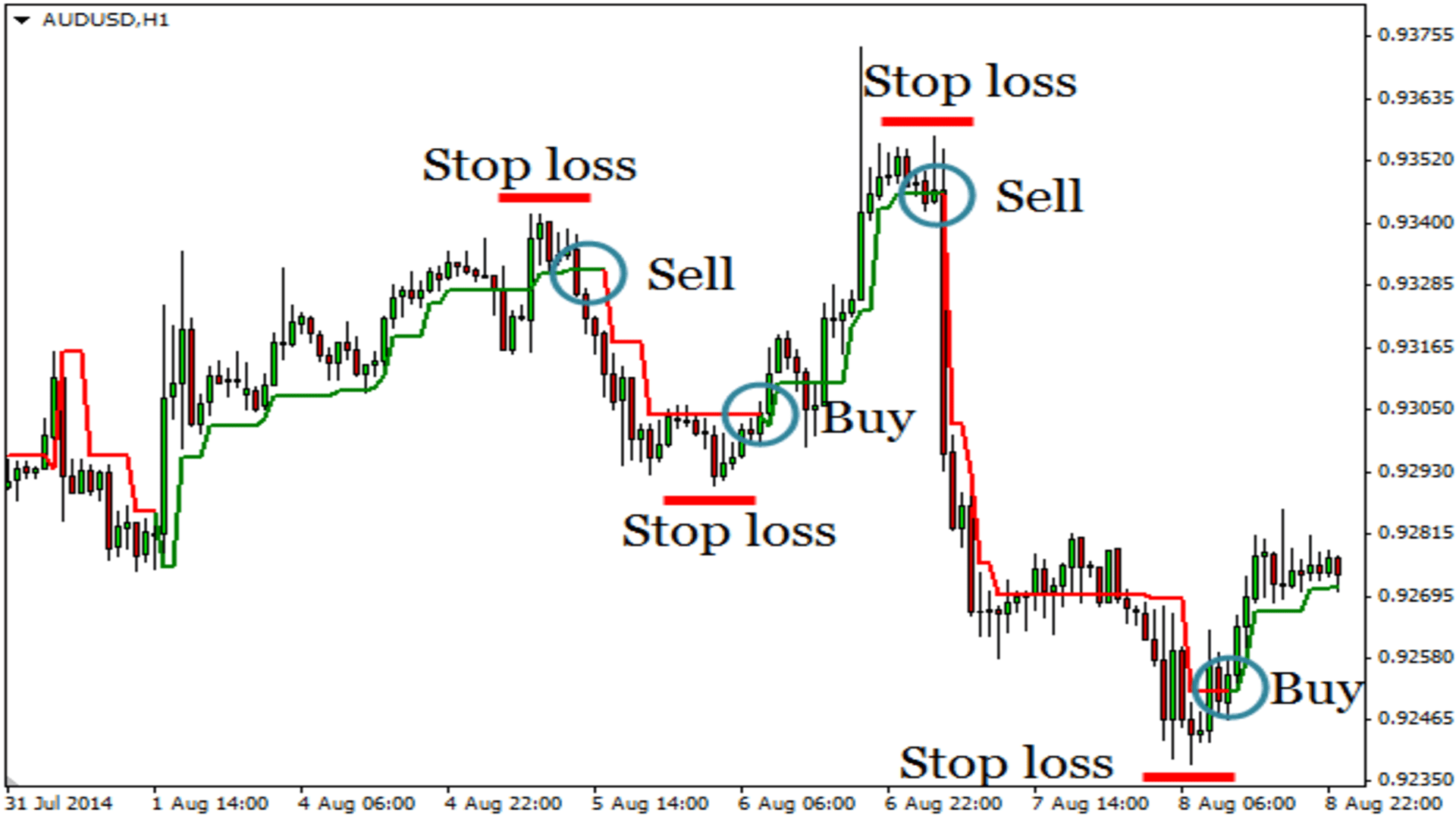

The Supertrend indicator is simple yet effective. When the indicator line changes color, it signals a trend shift. For example, a change from red to green suggests an uptrend is beginning, indicating potential buying opportunities. Conversely, when the line shifts from green to red, it signals a downtrend, suggesting it might be time to sell or exit.

This easy-to-use indicator provides clear insights, making it ideal for traders looking to quickly spot market trends. Its straightforward color-change mechanism offers instant visual feedback, allowing traders to act swiftly in dynamic market conditions.

Benefits of Supertrend

One of the key advantages of the Supertrend indicator is its ability to filter out market noise. This feature allows traders to focus on the main price movements, reducing the likelihood of false signals. Additionally, combining Supertrend with other indicators can further enhance trading strategies, offering a robust system for identifying optimal entry and exit points.

With Supertrend, traders can navigate the forex market with greater confidence. The indicator’s user-friendly design and reliable signals make it an excellent tool for both beginners and experienced traders, supporting informed decision-making in the ever-changing forex landscape.

Optimizing with Other Tools

To maximize Supertrend’s effectiveness, consider pairing it with complementary indicators like moving averages or Relative Strength Index (RSI). This approach can confirm trends and improve accuracy, making it easier to refine your entry and exit strategies. With this added layer of analysis, traders can better navigate various market conditions, increasing their potential for profitable trades.