Description

Forex Trading Strategy with Heiken Ashi, ADX, and HMA Indicators

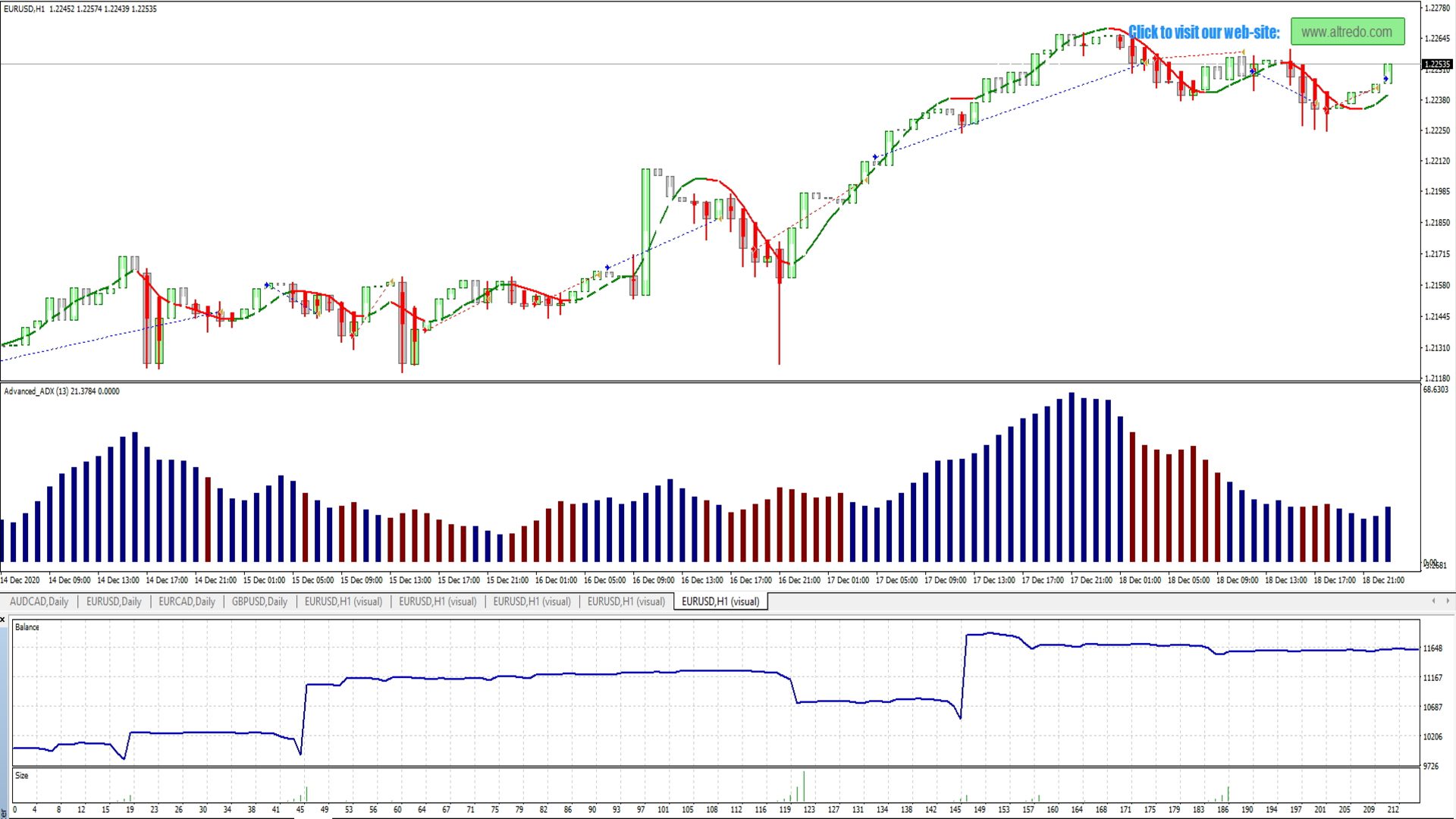

This forex trading strategy uses Heiken Ashi, Advanced ADX, and VininI HMA Sound Alert indicators to help traders identify precise entry and exit points. For a BUY position, wait until the Heiken Ashi indicator shows two consecutive blue candles. At the same time, both the HMA line and ADX indicator should also turn blue. If only the second Heiken Ashi candle is blue, wait for confirmation from the other indicators before opening a position. For a SELL position, the setup is similar but requires all three indicators to turn red.

The strategy is flexible and supports trading in long, short, or both directions, allowing traders to adapt to changing market conditions. It is recommended to apply this strategy on the EURUSD currency pair with a 1-hour timeframe. This setup has been backtested, showing optimistic results for potential profitability.

Advantages of the Strategy

Combining these three indicators provides a layered confirmation system. Heiken Ashi candles help smooth out price action, making it easier to identify trends. The Advanced ADX confirms trend strength, while the HMA acts as a quick visual signal to further enhance the entry and exit points. This triple-check process ensures trades are only opened when conditions are optimal, reducing the chance of false signals.

Additionally, the use of sound alerts from the HMA indicator ensures traders can monitor trades without constant screen time. When signals align, traders can confidently make decisions, relying on both visual cues and auditory alerts.

Overall, this strategy is ideal for traders who value accuracy and a disciplined trading approach. By relying on multiple indicators to confirm trends, traders can reduce risk and enhance their potential for successful trades. Reviewing the backtest results can provide valuable insights into the strategy’s effectiveness and help traders make informed adjustments for real-time trading.

Demo Video